Benefits of Investing Your HSA

Blog post

05/12/22A Health Savings Account (“HSA”) is an investment account used to save pre-tax funds that will grow tax-free to pay for medical expenses.

There is no downside to saving into an HSA due to its triple tax-free nature and a number of benefits. The first benefit is that you are saving pre-tax dollars in an HSA. Like contributions to your 401(k) account, if you make contributions through your employer payroll, you will see your contribution as a pre-tax deduction on your paystub. The second benefit is that all your contributions grow tax-free. If you are saving into your HSA and frequently using the funds for one-off medical expenses, we recommend you use cash on hand to pay for these expenses rather than your HSA savings as this will provide time for growth in the account. The longer the funds stay invested in the HSA, the greater the tax-free growth.

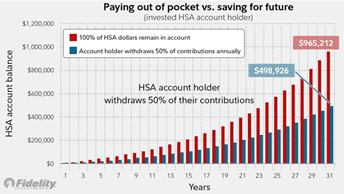

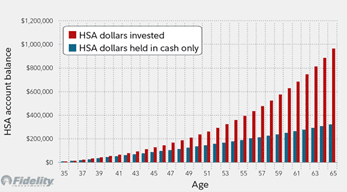

Not only is it important that you do not take distributions from your account early on, it is also important to make sure that the account is invested as soon as possible. If you are investing in the account on an ongoing basis, it allows for maximum growth potential in the account. In the charts below, you can see that a small withdrawal from your account, or not having the account invested, could cost you hundreds of thousands of dollars down the road.

In most cases, when you reach the age of 65 you are no longer permitted to make contributions to an HSA. In our opinion, that is the time to begin spending the funds in the account. The funds can be used for qualified medical, dental, and vision expenses. According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple age 65 in 2021 may need approximately $300,000 to cover health care expenses in retirement. With rising medical costs, it is unlikely that you will ever overfund your HSA balance. At 65, you are also permitted to use money in your HSA account for expenses other than medical expenses. The money used for these other expenses will be treated as ordinary income when withdrawn from the HSA, but this is no different than if you were withdrawing money from a retirement account or individual retirement account.

Anyone who is covered under a high deductible health plan (“HDHP”) is eligible to contribute to an HSA. Every year individuals can save up to $3,650 and families up to $7,300 (with a $1,000 catch-up for those 55 and older in 2022). Most employers will allow employees to save into their HSA plans directly from their paychecks. If your employer does not give you the ability to have contributions made from your paycheck, you are not out of luck. You can contribute to an HSA outside of an employer plan through most banks.

Each year HSA contributions are reported on federal form 8889 and filed with your return. You do not have to itemize your deductions to deduct your HSA contributions from your income.

If you are wondering where HSA contributions fit in your savings strategy, you should first start with your 401(k) contributions up to at-least the company match. After that, consider taking advantage of an HSA as not many other accounts offer the triple-threat of savings.