Highlights of the SECURE 2.0 Act

Blog post

02/02/23The SECURE 2.0 Act of 2022 (“Act”) was signed into law by President Biden on December 29th, 2022. The Act contains over 90 new provisions to offer more flexibility and incentives for those saving for retirement. Some provisions have already taken effect (starting 1/1/2023) while others will go into effect in 2024, 2025, or later. In this blog, I will highlight a few of the more relevant provisions for those we typically serve.

New Catch-Up Contribution Opportunities

- For IRAs, there is currently an additional $1,000 “catch-up contribution” for individuals who are 50 and older. Beginning in 2024, this catch-up contribution limit will be indexed for inflation.

- Starting in 2026, high wage earners (those who make over $145,000) desiring to make catch-up contributions to their workplace retirement plan will be required to make these catch-up contributions to their Roth retirement account.

- Beginning in 2025, there is a new “increased catch-up contribution” for retirement plan participants aged 60-63. The increased catch-up contribution will be the greater of $10,000 or 150% of the “standard” catch-up limit. (The standard catch-up limit for 401(k) contributions is currently $7,500).

Required Minimum Distribution (“RMD”) Changes

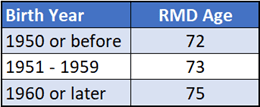

- The Act adjusts the age at which RMD’s begin. If you were 72 or older in 2022, you already began taking RMDs and this change will have no impact on you. For those who were younger than 72 as of 12/31/2022, your RMD age will be pushed back to 73 (or later). It is easiest to look at the chart below to determine what RMD age applies to you.

- Before this Act, the penalty for not taking your RMD was 50% of the shortfall. The Act adjusted that penalty to 25% and the penalty can be as low as 10% if the shortfall is corrected within a specific window of time. These penalty reductions became effective 1/1/2023.

- The age at which you can begin Qualified Charitable Distributions (“QCDs”) – which satisfy an RMD – remains unchanged at 70.5. However, the current limit of $100,000 will begin to be indexed for inflation starting in 2024.

Roth Provisions

- Employers are now able to provide employees the option of receiving vested matching contributions to Roth accounts. Previously, these matching contributions were only made on a pre-tax basis. Keep in mind it may take some time for plan providers and payroll systems to adapt and offer this new capability.

- The Act allows for the creation of SIMPLE Roth IRAs and SEP Roth IRAs.

- Beginning in 2024, a 529 account that has been established for 15 years can be rolled over to a Roth IRA for the beneficiary. There is an aggregate lifetime limit of $35,000 that can be rolled over. However, there are a few other requirements or stipulations to be sure to understand:

- Rollovers are treated as a contribution towards the annual Roth IRA contribution limit. In 2023, the limit is $6,500. Thus, it would take six years to convert $35,000 from a 529 plan to a Roth IRA.

- Funds you intend to convert from 529 plans to Roth IRAs must be in the account for at least five years prior to rolling over.

Other Workplace Benefits

- Expanded access to 401(k) plans – beginning in 2025, the Act allows part-time employees who have worked at least 500 hours for two consecutive years to be eligible for their employer’s 401(k) plan. The previous threshold was three years.

- Auto Enrollment in 401(k)’s – any 401(k) or 403(b) plan established after 12/31/2024, will now be required to automatically enroll eligible employees and include escalation features. The escalation feature automatically increases the initial contribution rate (which must be between 3% and 10%) and increases it automatically by 1% each year up to a minimum of 10% but no more than 15%. Keep in mind, this law just changes the default; employees who prefer not to participate can always opt-out.

- Small businesses (under 10 employees), new businesses (< 3 years old), church plans, and government plans are exempt from this provision.

- Student Loan / Retirement Savings Match – beginning in 2024, the Act allows employers to offer 401(k) contribution matches to employees who are making student loan payments. The employee’s payments to student loans effectively represent employee contributions to the retirement plan. The employee is then eligible for the employee match without making direct contributions to the plan. This incentivizes employees to pay off their student loans while still saving for retirement.

As stated above, these are just a few of the 90+ provisions the SECURE 2.0 Act added. It is rather complex and in-depth, so if you have questions or would like to talk with us further, please give us a call at 513-271-6777. For more THOR reading, click here to go to the Blogs and Market Updates section on our website.

Follow us on social media: