Good Debt vs. Bad Debt

Blog post

05/11/23You will probably take on some type of debt based on your financial needs and goals during your lifetime. Depending on the amount, interest rate, and reason will determine whether the debt is considered good or bad debt. Good debt typically has a low-interest rate, which will help build your credit score and increase your future net worth. Bad debt is the opposite. Understanding the differences in debt is important to ensure you are not taking on too much bad debt that could negatively affect your net worth and future goals.

Examples of Good Debt

- Mortgage

- Your mortgage, within your means, is considered one of the safest forms of debt. You can use this loan to build equity in your house. Accelerating mortgage payments may not always be the best financial decision. Instead, you could use the extra cash flow to invest in other investments with a higher return than the interest rate on your mortgage. This is especially true for people who refinanced within the last few years and have a rate between 2-4%. You can also benefit by taking advantage of the tax benefits when itemizing.

- Student Loans

- Student loans, to a certain extent, can be considered good debt because you are increasing your future earning potential with education. Although there are other factors to consider when taking out student loans, such as which school, public vs. private, or the amount, this is still a better option than credit card debt or personal loans. There are more options when it comes to forgiveness or repayment plans, and you can also take advantage of tax benefits if under the income threshold.

The question you should ask yourself about good debt is will this debt pay me back more than my investment in the long run?

Examples of Bad Debt

- Accumulating Credit Card debt

- Maintaining a balance on your credit card month to month can be one of the worst types of debt. These cards come with a high-interest rate, which can quickly become unmanageable as the balance increases.

- Other high-interest loans

- Other high-interest personal loans can be problematic as they become very costly and difficult to pay off as the balance increases. People end up in an endless cycle of payments because they are only paying the interest on the loans and never reduce the principal balance.

Bad debt can have a negative impact on your credit score. This will affect your ability to obtain good debt which can set you back on your financial goals. If you are currently struggling to pay down bad debt, here are a few things to consider:

- Analyze your spending! The first step in creating a budget for yourself is identifying where your income is going. From here, you can start to eliminate non-essential monthly expenses to replace those funds with extra debt payments.

- Develop a payment plan: Once you have analyzed your spending and know how much you can apply to your debt. Lay out a plan for yourself. A written plan with amounts and dates can be helpful in staying on track.

- Highest to lowest interest rate: This method recommends you pay off your debt with the highest interest rate and work your way down. This will save you money in the long run.

- Snowball method: The debt snowball is a method that recommends you pay off your debt in order of smallest to largest balance. This will develop momentum, motivating you to get rid of all your bad debt. If you start with the biggest balance, you will often lose motivation and stop making extra payments.

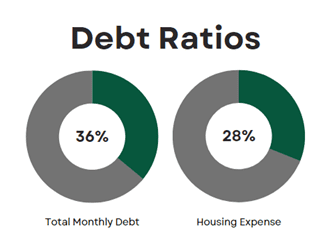

Debt Management Ratios

Being mindful about how much debt you are taking on can be another factor in the good vs. bad debt discussion. These are some general guidelines for how much you should spend on monthly debt payments.

The debt-to-income ratio should be less than 36% of your gross income, with 28% for housing expenses. For example, if you make $100,000/ year, you shouldn’t have more than $3,000/month ($36,000/year) towards your total debt payments. Of the $3,000/month suggested cap, about $2,333 should be the maximum for housing debt payments.

As always, you should review your financial plan before implementing any debt strategies or budgets into your life. If you have questions and would like to talk with us further, please call us at 513-271-6777. For more THOR reading, click here to go to the Blogs and Market Updates section on our website.

Follow us on social media: