How to Manage your Excess Cash

Blog post

08/20/20There are several types of qualified retirement plans employers can establish for their employees. The most common qualified plans are 401(k)’s, 403(b)’s, SIMPLE’s and 457’s. The IRS imposes limits on how much an employee can contribute to these plans each year. For those people with high incomes, it is possible to hit these IRS limits rather quickly. When this happens, how should you manage your excess cash?

The answer varies for each person based on his or her own priorities. It is always a good idea to discuss your options with your financial advisor before making a final decision. Assuming you have already established an emergency fund or cash reserve, here is the order in which we would recommend you manage your excess cash:

-

Make sure you are truly maxing out the plan:

- Let’s take a step back here. There is a difference between maxing out your retirement plan and maxing out your employer match. Often the company will match dollar-for-dollar if you defer 3%-6% of your salary. This is not actually deferring your pay up to the amount the IRS allows you to contribute to the plan. Your match might not increase after a certain point, but you can still put your money to work and get the income tax advantages by allocating more funds to the plan.

- Even if you have been maxing out in previous years, this does not mean that you are in the current year. These limits can increase from year to year to keep up with inflation. For example, the limits for a 401(k) increased from $22,500/year in 2023 to $23,000/year in 2024. Check annually to make sure your contributions keep up with any increases to the contribution amounts.

- Another thing to keep in mind is the catch-up provision. Those over 50 years of age can contribute an additional $7,500 on top of the $23,000 in 2024 (for an aggregate total of $30,500/year). Perhaps turning 50 isn’t always bad after all!

-

Roth IRA:

- In a previous blog, we discussed the importance of balancing your three buckets (taxable, tax-deferred, and tax-free). When saving to a Roth IRA, you contribute funds that have already been taxed. You won’t get a tax deduction like you do with a contribution to a traditional plan, but the funds still grow tax-deferred and earnings are withdrawn tax-free after age 59.5 (see the other withdrawal rules to Roth IRA’s here).

- Perhaps you have written off saving to a Roth IRA because you make too much money to be able to contribute. It is true that if you make over a certain amount of money (Roth contributions are phased out starting at $230,000 in 2024 if you filing jointly) you are not permitted to make contributions. However, there is a way around this limitation – it is called a Backdoor Roth. To take advantage of this planning technique, you first contribute to a non-deductible IRA, which has no income limitation, and then convert that contribution to a Roth IRA shortly after the contribution is made. This can be done once within a 12-month period.

-

Health Savings Account (HSA):

- HSA’s have many tax advantages. These accounts have all three tax advantages: contributions are tax-deductible, growth is tax-deferred, and (if used for qualified medical expenses) are withdrawn tax-free. The maximum contribution in 2024 for a family is $8,300 and unlike a Flexible Savings Account, the “use it or lose it” rule does not apply.

-

Employee Stock Purchase Plan (ESPP):

- This may apply to employees at larger corporations whose employers want to broaden the ownership of their company. ESPP’s allow employees to buy their company’s stock at a discount (up to 15%) – this increases the likelihood of realizing a gain once you sell the stock. Who doesn’t love a good sale, right?

-

Taxable Account:

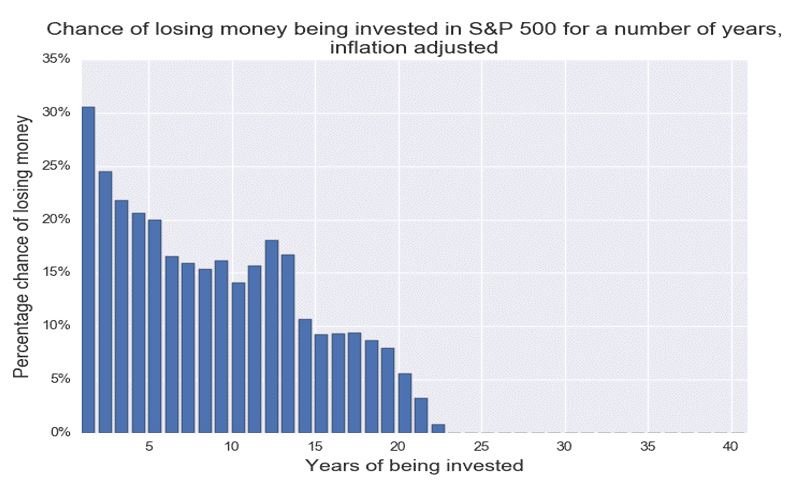

- Here is an account that applies to everyone. This is your standard post-tax brokerage account. It doesn’t offer many tax advantages; however, there is no limit as to how much you can save each year. If you want more growth (and can swallow the risk), this is a better alternative to just watching your checking account accumulate money. That’s because it allows your money to grow with the market rather than lose purchasing power to inflation. If you don’t need the money in the short-term, might as well invest it and watch it grow! The longer you’re invested in the market, the more likely your investment is profitable.

- Here is an account that applies to everyone. This is your standard post-tax brokerage account. It doesn’t offer many tax advantages; however, there is no limit as to how much you can save each year. If you want more growth (and can swallow the risk), this is a better alternative to just watching your checking account accumulate money. That’s because it allows your money to grow with the market rather than lose purchasing power to inflation. If you don’t need the money in the short-term, might as well invest it and watch it grow! The longer you’re invested in the market, the more likely your investment is profitable.

-

Pay off debt/mortgage:

- As I mentioned at the beginning of this blog, how you choose to manage your excess cash can vary. For those of us who are more conservative than others, debt repayment may be a higher priority. If so, feel free to pay off your debt first. Our philosophy on debt is to not allocate so much as to take away the ability to invest. That’s because the rate of return in the market tends to outweigh today’s standard interest rates. But in the end, money should not only be viewed logically but emotionally as well. If having debt keeps you up at night, it may be better to pay it off at a more accelerated rate.

As you get closer to retirement, it is important to work with your financial advisor and make sure that you have an adequate amount saved in each bucket. You may find that you need to adapt your savings strategy as your situation changes. Strategic deposits throughout your accumulation years can help ensure that your retirement income is maximized to its fullest potential.