Value vs Growth: What is the Difference?

Blog post

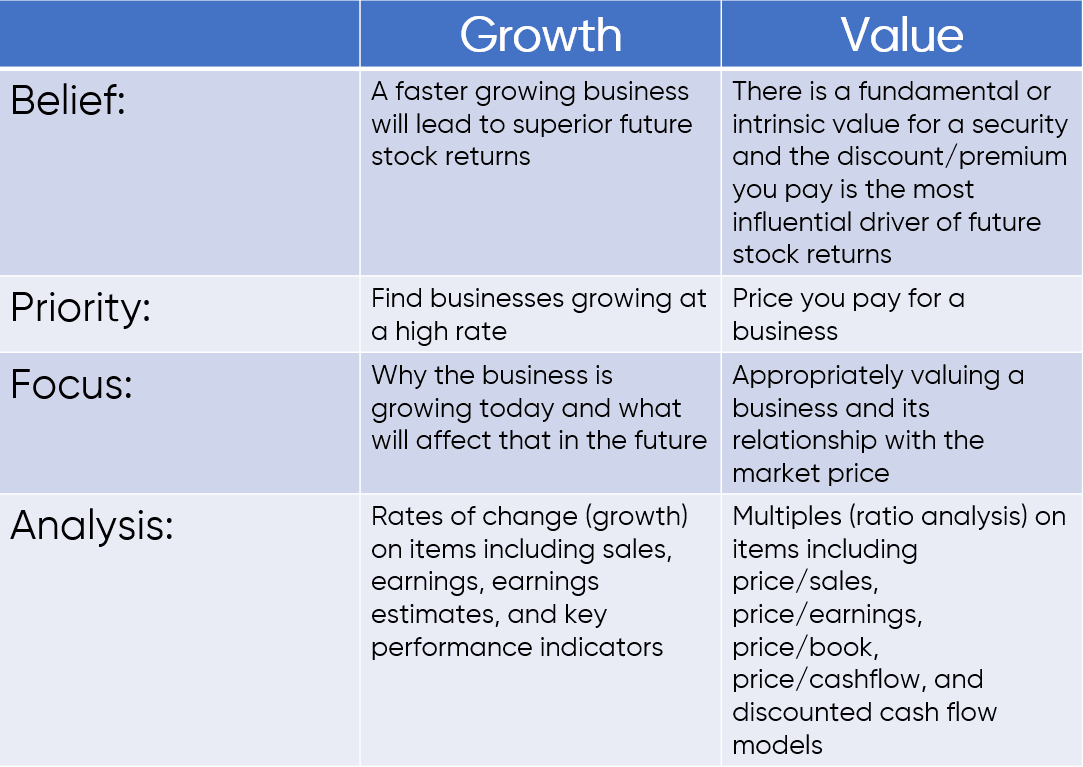

09/22/22Value vs Growth is a common theme in the investing world. Commonly investors will bucket a stock into either growth or value. The problem with this practice is that value and growth are not mutually exclusive. Growth and valuation are two separate considerations in evaluating a company or a stock. If a company exhibits high growth that does not mean the stock will always have a high valuation and vice versa. Instead, a more accurate way to differentiate growth vs. value is from an ideological perspective. Investors tend to lean toward value or growth like they would a political party. And the polarization between these camps comes from these fundamental beliefs.

What Is Growth Investing?

A growth investor’s priority is the rate of growth of the business. Conceptually they believe a faster growing business will lead to superior future stock returns. Said another way, their focus is to gauge a business’s velocity. In physics, velocity is the directional speed of an object in motion as an indication of its rate of change in position as observed from a particular frame of reference and as measured by a particular standard of time.

In plain language, growth investors believe that the speed of the business’ growth over time will dictate future stock prices. From an analytic perspective, growth analysts look at the rate of change of numerous factors. Commonly you will hear them say I buy stock XYZ because its growing at 25% compared to stock ACB which is growing at 5%. Here investors are looking at changes in major financial statement items like sales and earnings. They may also use more detailed items like changes in analysts’ estimates or key performance indicators unique to each business.

One thing that is certain in investing is that the future is uncertain. While a growth investor may have concrete understanding of a business’s current velocity, that does not mean trajectory will continue. For this reason, growth investors focus their analysis and study on why the business is growing today and what will affect that in the future.

What is Value Investing?

A value investor’s priority is the price you pay for the business. Conceptually they believe that there is a fundamental or intrinsic value for a security and the discount/premium you pay in the market is the most influential driver of future returns. Warren Buffet famously stated that “in the short run, the market is a voting machine but in the long run, it is a weighing machine.” Here the Oracle of Omaha was describing the force of value investing. People vote and move market prices in the short term but in the long-term returns are driven by the intrinsic value of a business. Going back to our physics analogy, Warren Buffett and value investors alike are gauging a business’s mass. Mass is the quantity of matter in a physical body. It is also a measure of the body’s inertia.

Value investors are trying to quantify what a business is worth and comparing that measure of worth(mass) to market price can determine the force of future price returns. Traditionally analysts will deconstruct financial statements and the accounting of a business to derive an intrinsic value. This may be as simple as looking at stock multiples like Price to Earnings Ratio (P/E) or Price to Book (P/B), or more refined by utilizing tools like Discounted Cash Flow models.

Value investors rely on the certainty of price because of the price transparency in financial markets. On the other side of the equation, there is no precise formula for intrinsic value. For this reason, value investors are deliberate on how to appropriately value a security and its relationship with market price.

Conclusion

There is no one way to make money investing. If you take a collection of the most legendary investors, you will see that they achieved success with different philosophies and strategies. While it is important to understand the differing concepts and forces of growth vs. value, it is equally important to understand that they are not mutually exclusive. Just because an object is traveling at a high velocity does not mean that it has a small mass. Moreover, combing the forces of mass and velocity can provide momentum in your portfolio.