Why the S&P 500 May Not Be the Best Benchmark

Blog post

09/22/23The goal of any active investment manager is to generate “alpha” for their clients. Alpha is defined as the excess return in relation to a benchmark (aka “beating the market”). Benchmarks are essential in investing because they give the investor a comparison for how their portfolio is doing relative to the market.

A vast majority of investors reference the S&P 500 as their benchmark for the equity market. In fact, you frequently hear people compare a particular investment with the S&P 500 – as if it is THE benchmark or the only benchmark. You’ll often hear of a certain stock headline the news by how much it is “beating the S&P” or “lagging behind the S&P”. However, this blog will outline important characteristics of a good benchmark and why the S&P 500 may not be the best comparison for your investments.

Define your “market”

First and foremost, regardless of your investment objective, you want a benchmark that is an apples-to-apples comparison for what you are trying to accomplish. Most wealth managers, like ourselves, are diversified investors and will spread their clients’ assets across several asset classes and sectors. As a result, if you are building diversified portfolios, you should also have a diversified benchmark.

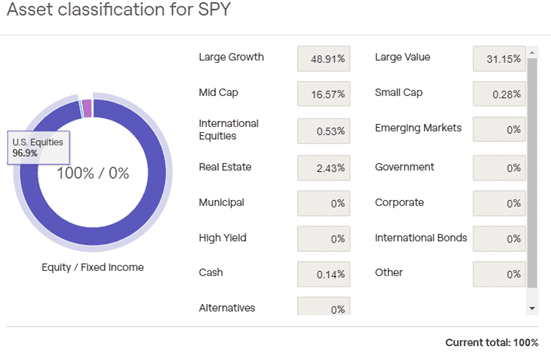

How diversified is the S&P 500? SPDR tries their best to mirror the S&P 500 via their exchange-traded fund (ETF) labeled with the ticker ‘SPY’. Here is the breakdown of its composition:

There are a couple of things that stand out to me:

- Almost half of the fund is in US Large Cap Growth companies.

- ~97% of the fund is invested in the US.

- The index almost entirely neglects small cap companies as well as the international market.

- The fund places a major tilt toward large companies (> 80%).

I would not consider this diversified by any means.

Understand how your benchmark is calculated

There are three ways an index calculates its value: equally weighted, price-weighted, or market capitalization-weighted. Equally weighted indexes give each holding in the fund an equal weight. Ex: if you had 100 positions, each holding would make up 1% of the index. An index that is price-weighted is more impacted by companies with the highest stock price. Lastly, market capitalization-weighted indexes are more impacted by fluctuations from the companies with the largest value (or market cap). The weighting for each company is the proportion of their market cap as a percentage to the entire value of all the market caps in the index.

Although the S&P 500 includes the 500 largest stocks in the U.S., the top 10 companies make up > 30% of the index because it is market-cap weighted. This can really skew a benchmark. For example, Invesco’s Equally Weighted ETF (Ticker: RSP) was up 12.71% in 2020. But the market-cap weighted SPY returned 18.37% in the same year. However, if you look closer, by removing just the top 7 companies from consideration that year (Apple, Amazon, Facebook, Google, Microsoft, Netflix, and Nvidia) the return for SPY was a measly 3.34%!

If 7 of 500 names in the fund (or 1.4%) have that much of an impact on the return, I would think twice about using the index as a benchmark. Not to mention, all of those names are from one sector! They are all large-cap growth, technology stocks.

Conclusion

At the top of this blog, I mentioned that any investment manager’s goal is to generate alpha for their clients. However, investment management is just one area where your advisor can add value (or alpha) for your entire financial life. Vanguard’s research touts that a financial advisor can add about 3% of total alpha, net of fees, through additional services like financial planning and tax planning.

If you have questions and would like to talk with us further, please call us at 513-271-6777. For more THOR reading, click here to go to the Blogs and Market Updates section on our website.

Follow us on social media: